Whistleblower exposes insider trading program at JP Morgan

Legal insider trading in three easy steps, brought to you by JP Morgan and the SEC

KEVIN WILSON, MARIA CHRISTINA PADRO, JULIAN ASSANGE & staff

March 16, 2009

A confidential memo obtained by Wikileaks shows that not only has the U.S. Securities and Exchange Commission created an insider trading loophole big enough to drive a truck through, but that Wall Street is taking full advantage of it, establishing ‘how-to’ programs and even client service divisions to help well-heeled clients circumvent insider trading regulations.

Most of us think of insider trading as illegal. It allows those with inside knowledge to tilt the playing field, with the small investors invariably losing to the privileged few. Unfortunately for the small investor, the big boys get to play by different rules, and it has all been made legal, thanks to the SEC.

In 2000 the SEC promulgated Rule 10b5-1. The new Rule was designed to address the confusion caused by a series of court decisions that had left investors uncertain about what constitutes insider trading. Rule 10b5-1 was designed to “clarify” what constitutes illegal insider trading.

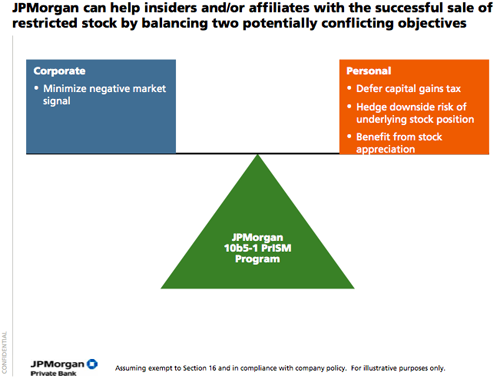

But top Wall Street houses were not to be deterred from advantaging their big clients at the expense of their small ones. Wall Street firms like JP Morgan found loopholes in Rule 10b5-1 that allowed them to continue trading on inside information “legally.” Indeed, JP Morgan has gone so far as to set up an entire ‘selling program’ within its Securities division to help their clients profit from the loophole.

Documents obtained earlier this month by Wikileaks from JP Morgan Private Bank, which subtitles itself as “World class solutions for wealthy individuals and families”, show the firm has a dedicated ’10b5-1 Selling program,’ along with a ‘dedicated 10b5-1 team’ to help its clients take advantage of the loophole.

Here’s how it works:

1. An insider client transfers all or a portion of their company stock into a JP Morgan Securities Inc. brokerage account.

2. The insider then develops, in conjunction with the 10b5-1 team, a ‘phased, pre-planned sales program to be executed at either market or specified prices’.

3. Depending on the information available to the insider (but not the public), the insider can decide whether to execute the sale or not.

By gaming the system this way, JP Morgan teaches insiders how to use their knowledge to create a rigged market, one in which it is the “house” that always wins, and the small investor that always loses.

Alan D. Jagolinzer, an assistant professor at Stanford University Graduate School of Business, completed a study of roughly 117,000 trades in 10b5-1 plans by 3,426 executives at 1,241 companies. He found that trades inside the plans beat the market by 6% over six months. By contrast, executives at the same firms who traded without the benefit of plans beat the market by only 1.9%.http://businessweek.com/magazine/content/06_51/b4014045.htm

One can only guess at how many wealthy executives profited under JP Morgan’s “insider trading program,” leaving small investors holding the bag.

See the full confidential JP Morgan Private Bank insider trading memo:

JP Morgan Private Bank was successfully contacted by Wikileaks, but declined to comment on the report.

Additional contacts

JP Morgan Private Bank

Prof. Alan D. Jagolinzer

Tax Justice Network

Leave a Reply

You must be logged in to post a comment.

NoScript extension

NoScript extension