Who wants to be a millionaire?

From BSC

Central banks start to abandon the U.S. dollar – From the Wallstreet Blogs, Fortune, CNN

“Just last week, America’s debt lept $166 billion in a single day. That one-day run-up is greater than the entire U.S. annual deficit in 2007. And Americans, the world’s consumers, continue much of the behavior that helped the U.S savings rate drop so low.

The dollar has been in free-fall since 2007.

Last year, both China and Russia have questioned why the dollar should be the world’s reserve currency. (Naturally, they were advocating for the ruble and yuan).

A new report from Morgan Stanley analyst Emma Lawson confirms what many had suspected: the dollar is firmly on its way to losing its status as the reserve currency of the world.

And just last week, the United Nations released a report concluding that the dollar should no longer be the world’s reserve currency because it is not stable enough. The dollar is down 5% over the past month, and even currency traders don’t see it as a safe haven any more.

There is certainly an element of economic competitiveness in those statements from foreign bodies and governments, but at the same time, Americans houldn’t be surprised that, in these touchy times, central banks want more of a measure of security than the dollar can afford right now – particularly when we’re running up an enormous deficit through the costs of stimulus programs and two simultaneous wars.”

———————————————————————————————————–

The US Dollar is losing reserve currency status because it is being over inflated to near worthless proportions, by being printed with wreckless abandon by PRIVATE CORPORATE BANKS.

If we do not take back the power to issue our own currency, as provided by the US Constitution, we will never escape the DEBT SLAVERY that occurs by allowing private central banks to loan us our own money at interest! This currency black hole creates inflation and loss of value because every dollar “borrowed” comes with debt attached, and in order to pay the interest on the first dollar we have to borrow more dollars, again with more interest! These bankers have run this same scam in other, less sophisticated countries. Now they’re running it here.

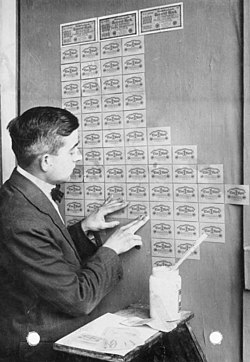

These are real images of devalued, inflated currencies from the last 60 years. Some so worthless that the people use them as wallpaper or simply throw them away. Imagine a loaf of bread costing 200 billion dollars! Thats what they pay in Zimbabwe.

DON’T BE A SUCKER!

Leave a Reply

You must be logged in to post a comment.

NoScript extension

NoScript extension