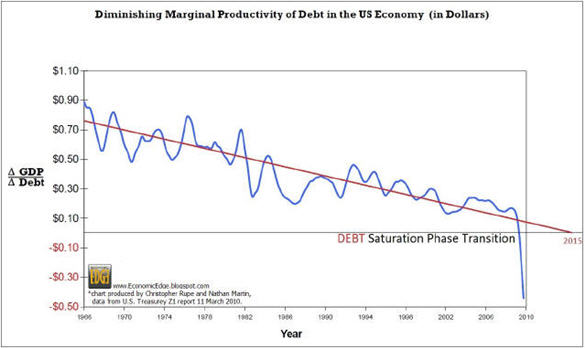

Too much debt…

I keep saying the US has too much debt. Being that the USD _IS_ compounding interest mortgage debt (95% of money was created via mortgages) this graph should show what any new stimulus and growth in credit expansion will actually do. This is especially true if the money is given directly to the banks (with their ability to leverage) instead of reducing debt via money to home owners. (Giving money to home owners would be a problem for banks as their assets would be reduced! sigh.)

All the efforts by government and the Fed to make more money is really only pushing on a string they don’t understand. This time the problem is different. It’s the same solution to a radically different problem. This time their efforts are destroying the economy, not fixing it. I’d argue that all their efforts before were destroying the economy in their own way but at least the problem wasn’t was it is now. The point I’d like to make on this is that every time the economy went to weed out the unproductive businesses, the fed stepped on the gas. This only built bad businesses into the economy instead of letting them fall away. Structurally, what the Fed has done is breed weakness into the economy through it’s policy. All this weakness needs to be flushed but each passing minimal-recession they had only made this problem worse. The flushing that we need now (30 years after the Greenspan Put) is going to be so big and bad… I wouldn’t be surprised if we aren’t already in the starting phases of The Greatest Depression. This inherent weakness is what we base our economy upon now.

PS. Numbers and equations don’t tell you what is going on in people’s heads. Keynesian can’t predict a loss of confidence in the dollar. Austrian economics is predicting this especially if we continue in our Keynesian ways!

PPS. Our money is debt regardless of whether you believe it is or not. How else is it possible that the entire Planet Earth owes more money, to the banks, than exists?

Leave a Reply

You must be logged in to post a comment.

NoScript extension

NoScript extension