Comex comes unglued from reality [updated]

Over the past few weeks, I’ve been quietly watching Comex metal prices plummet and not freaking out in the slightest, because the Comex is a fractional receipt market, and can be manipulated. Many people buy and sell gold futures contracts on Comex and do not actually take physical delivery of the metal. Thus, Comex can sell receipts for metals they don’t even possess, at a lower price (aka “naked short selling”) in order to drive the price down termporarily, knowing hoping that not everyone will demand physical delivery of the metal at once. Naked short selling is a form of market manipulation that can enable insider trading.

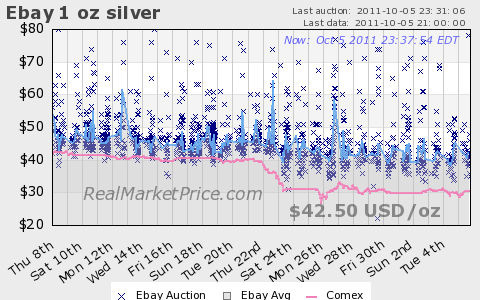

Realmarketprice.com scrapes Ebay and other sources for market data and generates charts. As you can see in the silver chart, the price of physical 1 oz coins on Ebay is fairly stable while the Comex begins to decline around the 21st. The ratio of Comex to physical is an interesting number to consider, especially when it it remains stablefor a while, goes down, then remains stable at the lower price. What probably happened here is they sold a whole bunch of silver contracts for silver that doesn’t exist, at a lower price, and that drove the price down. Problem is they’re selling paper and calling it silver.

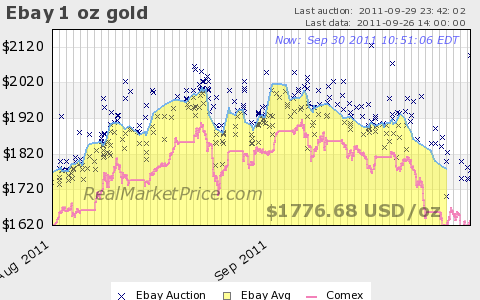

In the chart below, note that the divergence of physical and Comex gold is less pronounced than with silver but has still increased over the past 1-2 weeks. Due to a large amount of real metals being traded on the Comex, it does influence the market greatly but go ahead and try to get phsyical delivery of Comex gold now. The lead time will probably be quite long, if it’s even possible. They would more likely have a policy to say “We’ll just pay you our [fake] spot value in dollars for your contract, but due to availability you’ll have to wait a few months for delivery,” and most Comex receipt holders will accept the currency for their contract.

If the receipts outnumber the physical gold 100:1, then what happens when everyone realizes this and starts asking for delivery of the physical gold? Comex is supposed to be a futures market for a commodity, but they’ve created receipts for gold that doesn’t exist (or hasn’t been extracted and refined yet). This is fraud, in my humble opinion, and needs to end.

Leave a Reply

You must be logged in to post a comment.

NoScript extension

NoScript extension